In the UK, tips are discretionary rather than compulsory. But they could be taxed when they are given to bar staff, waiters and other hospitality workers.

Table of Contents

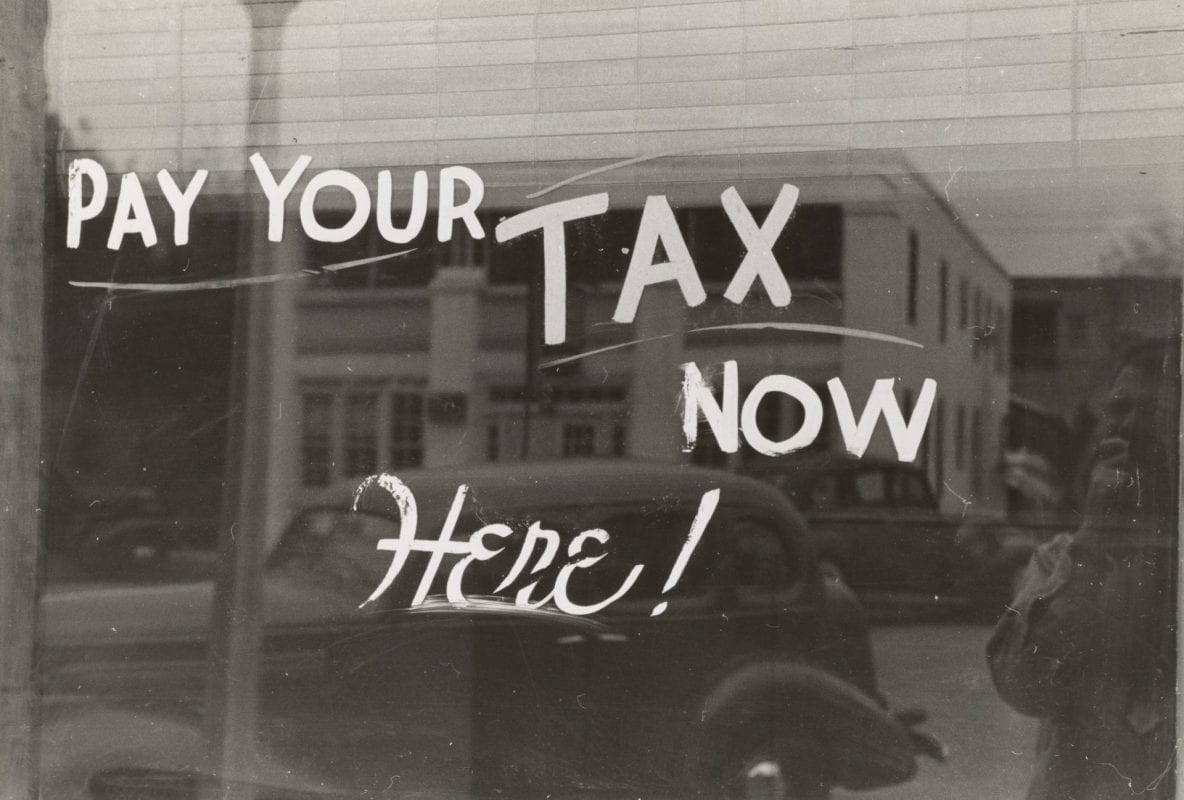

Are tips taxable?

Yes. Tips are subject to tax and, in some cases, National Insurance (NI), depending on who received the tips and how they are shared out.

- Tips given directly to wait staff are taxable, but are exempt from NI.

- Tips given in card or cheque payments are taxed through the PAYE system by the employer.

- Tips pooled together are subject to income tax and paid through PAYE.

What is a tronc?

Troncrefers to tips pooled together, and the person tasked to look after the tips are called the troncmaster. They are also responsible in ensuring income tax is paid. With this arrangement, the employer must inform HMRC that atronchas been agreed upon, and the identity of the troncmaster.

What is the problem with the UK Tipping System?

TheUK Tipping Systemhas been viewed as unfair, particularly from diners who expected their tips to go to the staff who provided them with an excellent service. In 2014, the Conservative MP for Brigg and Goole, Andrew Percy, accused some restaurants firms of stealing as much as 50% from worker’s tips.

Unfortunately, the system is confusing to a lot of people, with many having no idea how to differentiate between tip, service charge and gratuities.

Regardless, the fact remains that tips are taxable, whether given directly to hospitality workers or wait staff, or pooled in atronc.Think you may be due a tax refund? Apply here to get your tax back.