Table of Contents

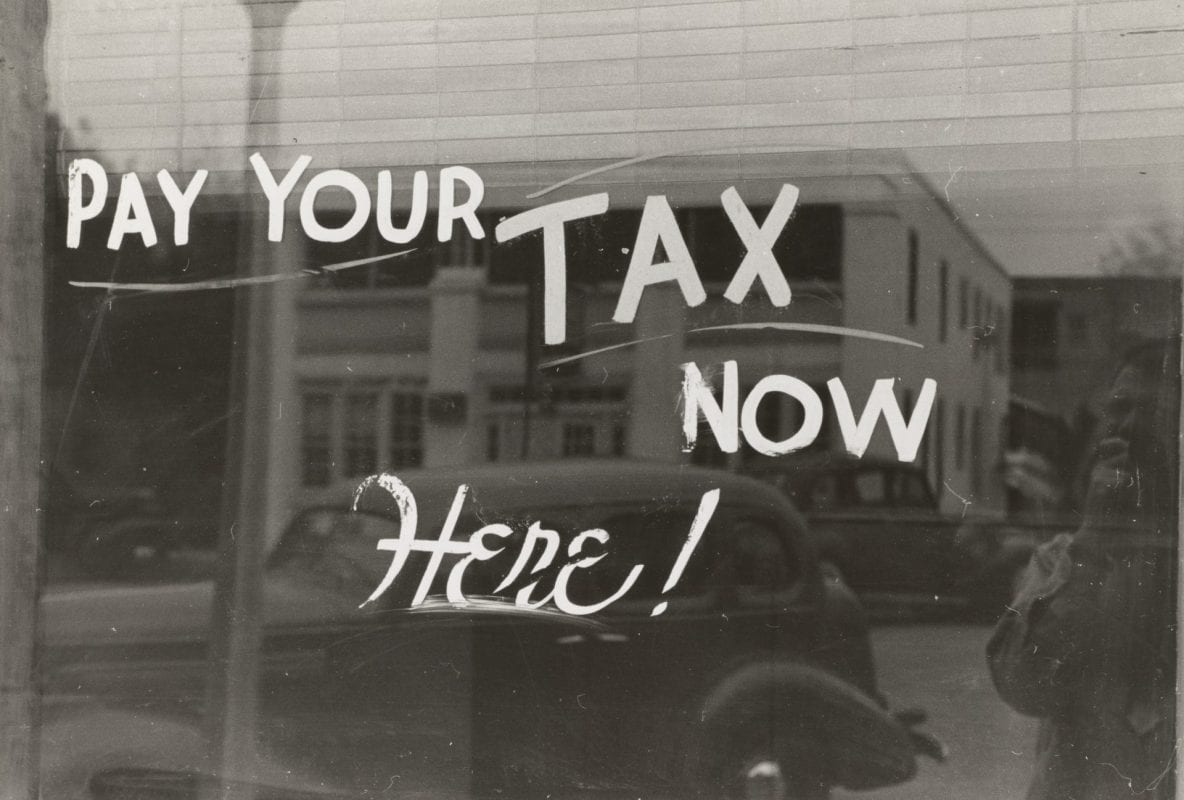

Time to Meet that 2019 UK Tax Filing Deadline!

There are over 740,000 tax payers in-line to receive fines for missing their deadline to file tax returns. Official notices, however, will not be sent out until April as announced by HMRC. If you met your 2019 UK tax filing deadline your tax returns for 2017/18 would have been sent out to meet the January 31st, 2019 deadline. If you have not there will be penalties, the longer the delay, the longer the penalty on your tax returns!

How much of a penalty will be charged for Delayed UK Tax Returns

As mentioned above, the longer you wait, the higher the penalty, January 31st 2019, was in fact, the deadline to file all UK tax returns, which includes self-assessed tax returns which can be filed online or via paper.

Anyone who missed the January 31st 2019 deadline will automatically receive a GDP 100 fine, plus you could be looking at GDP 10 per day for taxes as late as three months. Probably a pretty good reason why penalty notices are delayed! Which is where we come in, enlist the help of qualified UK tax accountants at Taxback.co.uk and you can rest assured your tax matters are taken care of on time. Besides, saving you those heavy penalties, we can ensure you do not pay more tax than you owe and get your just dues in tax returns from HMRC. You may even secure a tax refund.

Related Post: How To Avoid UK Tax Penalties

HMRC Fines for Late Filing of Tax Returns

- 1 Day Late – £100 GBP

- Up to 3 Months Delay – On top of the initial £100 fine, a penalty of £10 for each day, 30 day cap, maximum fine value – £1,000

- 6 Months Late – Whichever of the following is higher £300 or 5% of the due tax value, plus the above penalties

- 12 Months Delay – Another £300 or 5% of the tax value, plus all of the above penalties, while in some cases a 100% value of tax due is charged as penalty

What if I Avoid Paying my Taxes?

If you ignore your penalty notices, HMRC will pass the matter on to debt collectors and the entire case will end up in courts; which is why we are often sought out by busy taxpayers to handle their sensitive affairs and avoid paying exorbitant rates in penalties. Even if you are faced with penalties, please talk to us, for a professional evaluation on how ‘cost-effectively’ the matter can be resolved.

Related Post: How To Claim Back Your Unpaid Tax