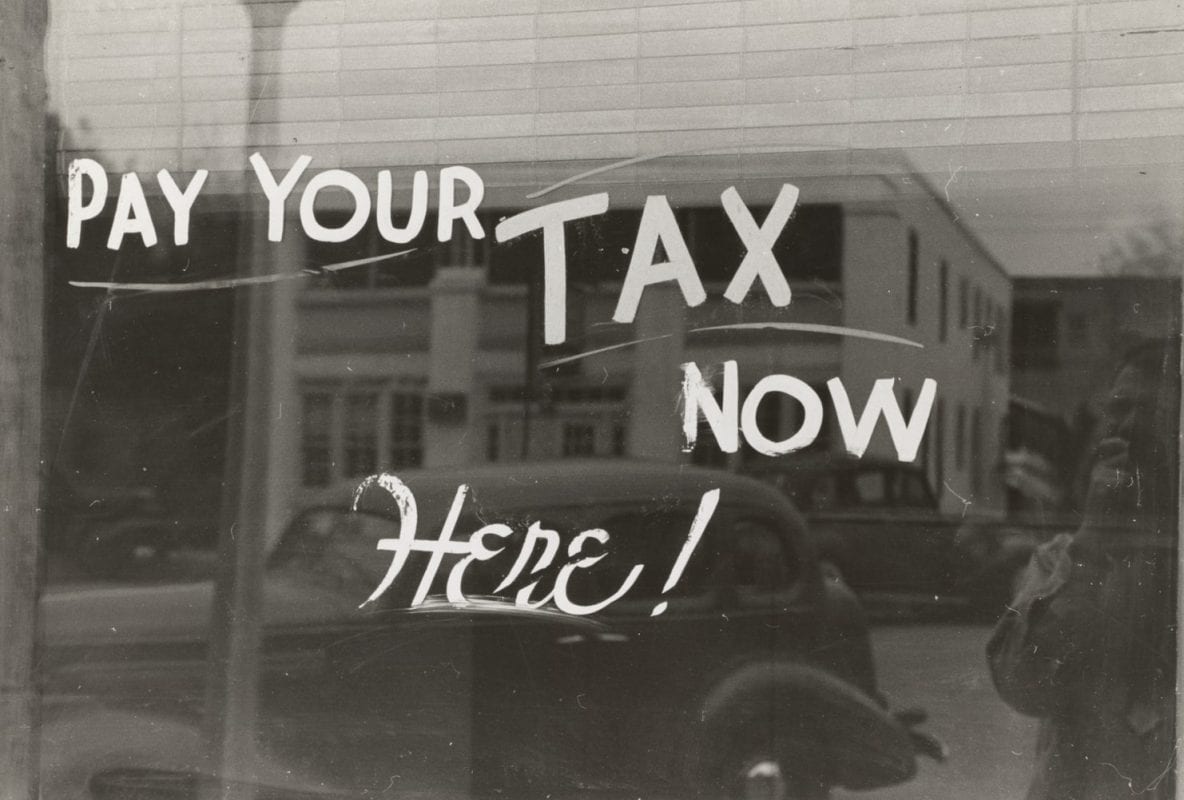

Just moved to the UK and wondering about paying tax. Let’s make sense of those complicated UK tax laws and update you on UK working holiday tax return for non-residents UK tax laws are complicated and confusing, especially, if you have just moved to the country and are eligible to pay income tax. This article […]

Is this an issue keeping you up at night? Act fast and avoid further penalties. Read on for advice on how to avoid paying heavy penalties and claim your UK tax refunds. As a leading tax refund company in the UK, we know there are hundreds of taxpayers who have failed to submit their self-assessment […]

If you have received a fine from HMRC, our guide will tell you how to appeal a Self-Assessment penalty, get it delayed or reduced. If you appeal to the tribunal, HMRC will wait for your payment until the tribunal sorts out your appeal. What’s important is that you act fast and get help. The best […]

It’s that time of year when UK Self Assessment tax returns must be prepared and submitted to HMRC on the 31st January. If you’re not organised this task can be time consuming, and can be daunting and stressful but nevertheless it has to be done or you will receive a late filing fine. Do You […]