Claim Your Tax Return Before Leaving The UK If you’re a student who has finished your studies, have been working in the last few months and are planning to leave the UK, then you should be hurrying up the tax man. It doesn’t make sense to up route and leave behind a tax rebate that […]

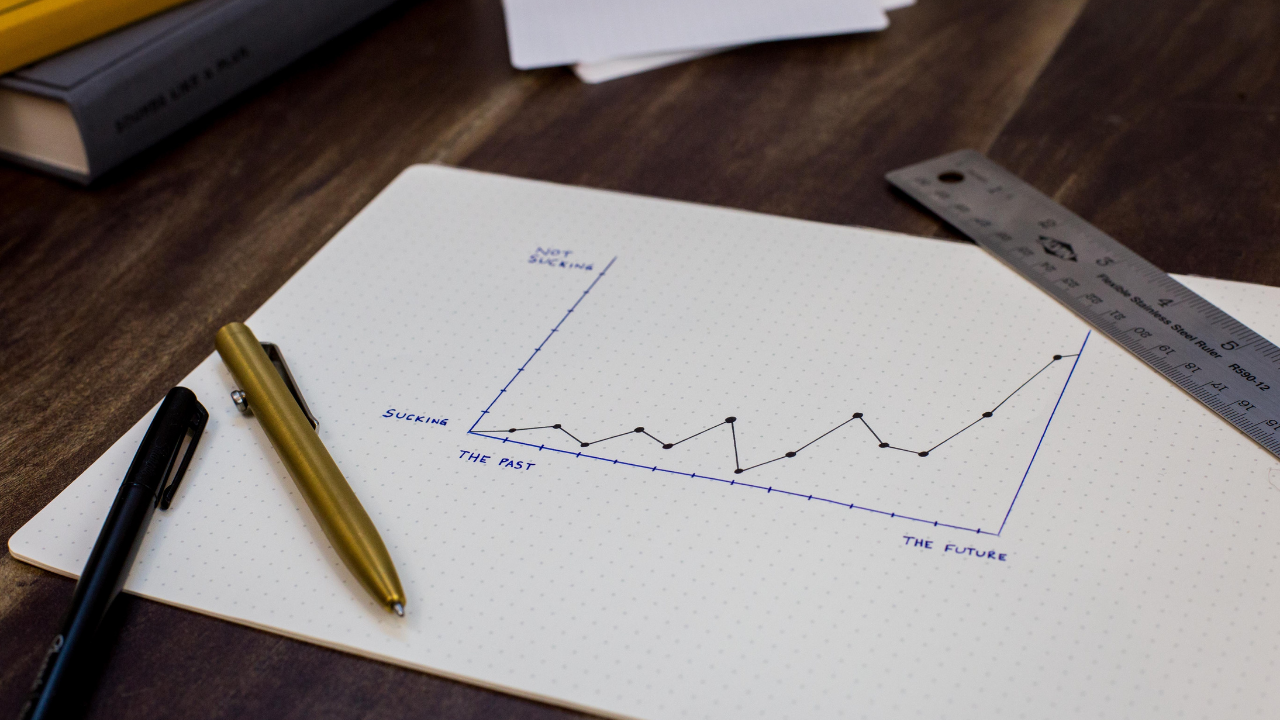

The Negative Implications on Your Finances Filing of tax return for the tax year 2013-2014 was due last 31 January 2015. But some 890,000 people still missed the cut off and is now facing an instant fine of £100. This means, HMRC has already earned £89 million. Depending on whether or not late tax returns […]

What the New Immigration Laws Mean To Foreign Entrepreneurs Starting a company in the UK is easy even for foreigners. The economy is strong and thriving, and it needs a small business to continue to grow. If it is provided by a foreigner, then it’ll be more than welcome. Moreover, business grants and funding are […]

IMPORTANT TAX APPLICATION NOTIFICATION Due to new changes in legislation from the government, all payments by agents to client’s U.K. and overseas bank accounts now require photo evidence of the recipient. Would you therefore kindly upload/email the photo page from your passport/ID or current driving licence. Photo by Ilya Pavlov on Unsplash

The Rule That Will Put an End to Expats’ Tax Evading Days In a year’s time, expats who have enjoyed not paying taxes may have to move to another location to buy more time or face the punishment every tax dodging individual deserves. New rules on transparency will soon put a damper on their evasion […]

How The Double Taxation Agreement Help You Many students in the UK, who work at the same time, have the impression that their income doesn’t get taxed. But some are actually taxed, depending on various factors. This is why students who do not fully understand how the UK tax system works and its effect could […]

Self Assessment Online For Foreign Teachers Working In The UK For an overseas trained teacher in the UK, worrying about the tax details might not be a primary concern. But because failure to file your tax return can mean paying for fines, you should make it one of your priorities. For your convenience, you can […]

UK residents are usually taxed on the arising basis. If you are not domiciled in the UK, however, you can use an alternative tax treatment known as the remittance basis. What Is It Exactly? The remittance basis is a tax treatment where non-UK income and gains are taxed if and only if they are brought […]

With the FIFA World Cup catching the attention of most people in the world, we’ve decided to look back at the big names in the sport that have been caught up with tax fraud claims. In 2013 the biggest name in football, Lionel Messi had to defend himself against fraud accusations made against him. Over […]

How to Claim Taxes for Americans Working in the UK US citizens working in the UK, or other parts of the world for that matter, are subject to US income tax. If they happen to be a resident of theUK, they are also subject to UK taxation rules. This often leads to double taxation, which […]