While paying taxes isn’t something we want to think about, putting it off for too long can mean we end up paying fines and we could have to pay more than we should. In most cases, people lose out on receiving the tax back they are owed simply because they’re unaware of what they can legally claim tax relief on. To help you get more cash in your pockets and ease the pain of learning all the details, we have compiled a few key pointers to help you find out what a self-assessment tax return is and how to complete one via our website.

Self Assessment Tax Hacks – Keeping Tax as Simple as Possible

Our self-assessment tax hacks are updated regularly based on the latest tax news and legislation. Although we do our best to ensure the information is up to date, it is essential to understand that tax is a complex and very personal matter. To avoid falling foul of the rules, we recommend contacting one of our tax professionals, if you have questions or concerns about submitting your self-assessment tax return online.

Understanding UK Tax and the Jargon That Comes With It

The information in our self-assessment tax return online guides are provided to help our clients and readers learn more about how to submit self-assessment tax returns online. We aim to keep things simple and easy to follow, however our team of UK tax advisors are available to answer any questions you might have via online chat or email.

Table of Contents

What is A Self Assessment Tax Return?

You must complete a Self-Assessment Tax Return if any of the following apply:

- Self-employed as a ‘sole trader’ and earned more than £1,000 (before taking off anything you can claim tax relief on)

- A partner in a business partnership

- A higher-rate taxpayer

You will not usually need to send a return if your only income is from your wages or pension. But you may need to send one if you have any other untaxed income, such as:

- money from renting out a property

- tips and commission

- income from savings, investments and dividends

- foreign income

If you are self-employed, you must declare how much you earn and pay the required tax by the annual deadline. This applies to everyone from builders and freelance writers to students and young people who are on gap years or working abroad. There are, of course, many levels to this process. In this guide, we will walk you through the UK Self-Assessment process and provide you with tips and hacks to help you complete your tax return.

How do I Know if I Need to File a Self-Assessment Tax Return?

How do you know if you need to file a self-assessment tax return? In brief, if you work for yourself, invoice or receive payments from clients for services you deliver or items/products you provide, you are required to register as self-employed with HMRC. You will need to keep details of all your transactions, so accounts to manage your book keeping and record keeping for tax purposes.

Do I Need to Complete a Self Assessment Tax Return?

Most people in the UK pay their taxes through PAYE (Pay As You Earn) if a company or person employs them for part-time or full-time work. If, however, you work for yourself as a freelancer or contractor, then you will be classed as self-employed and must register with HMRC. You will need to submit a self-assessment tax return if any of the below criteria apply to you:

Who Needs to Submit a Self-Assessment Tax Return?

If any of the below apply to you, you may need to submit a UK self-assessment tax return…

- You are self-employed (Small business owner, entrepreneur, company director)

- You are a full-time or part-time freelancer or contractor

- You are a minister of religion

- You are a trustee of an estate

- You are a partner in a business

- You are a company director with an income that is not taxed under PAYE

- You receive annual income from a trust or settlement

- You receive foreign income

- You receive money from renting out a property

- You receive tips and commission

- You receive income from savings, investments and dividends

Self Assessment Returns for Self-Employed or Freelancers

If you are a sole trader, self-employed, or work freelance, you must fill out a self-assessment form. Due to the fluidity of Britain’s workforce, it is common for your circumstances to change in one tax year. People can move in and out of having to make a self-assessment return. This is why HMRC highly recommends that you keep them informed of the changes in your employment.

Are you looking to find out more information on Self-Assessment? Speak to our team, who would be happy to answer any of your questions, from self-assessment tax return deadlines to how best to file a tax return.

I’m Working Abroad – Filing a Tax Return Online.

If you’re working in the UK, you can file an online return by the 31st of January. Failure to meet the deadline will result in an automatic penalty fine of around £100.

However, things get a little more complex if you work in a foreign country. This also means you may be due tax relief if you’re classed as a non-resident. You’re likely to have heard of expat tax. If you’re living overseas permanently, you’re currently in the club.

As an expat, it’s a good idea to use a tax agent! We’re pretty knowledgeable about managing tax affairs and over the years, we have built up a strong client base of international clients who live in all corners of the world.

UK self-assessment tax returns must be submitted every year if registered as self-employed with HMRC. If you’ve recently moved overseas or are planning to, it’s a good idea to do some tax planning before you leave or before the self-assessment tax return filing deadline on the 31st of January.

You’ll also want to remember to pay any tax you owe by the deadline mentioned above. Failure to do this could result in a fine which can be easily avoided by using a tax agent to handle your submissions and paying what you owe before the deadline.

When Don’t I Have to Pay UK Tax?

This is the part that most people jump to straight away, so well done if you have read the rest of the article first! If your income from self-employment was less than £1,000 in the last tax year, then you’re exempt. You should be aware that tips and commissions only become taxable when they total more than £2,500. If you exceed that threshold, you’ll only pay tax on the amount you earned above £2,500. Not a bad deal!

According to HMRC, “people who owed a small amount of tax from savings income or occasional extra work” do not need to worry about filling out self-assessment forms. You do not need to spend time compiling statements, invoices and completing forms. Yay for you!

Tips for Filing your UK Self-Assessment Tax Forms Online

Before you fill out your UK tax returns, you must have all the necessary paperwork at hand, including income from self-employment, employment, property and other income gains – savings, investment returns, and any other income and expenditures. This includes documents such as Form P60 from your employer, which shows income and tax paid by you, Form P45 if you have left a job midway through the tax year and Forms P11D and P9D, which details all benefits plus expenses. We’ve included a few quick points to help you prepare for your self-assessment tax return submission.

- The deadline for filing an online UK self-assessment tax return for 2020-21 was the 31st of January 2022. You can file your self-assessment tax return online if you have missed this date.

- The current self-assessment tax year is from April 6th 2022, to April 5th 2023.

- The tax submission deadline for the 2022-23 tax year is the 31st of January 2024.

- The 2021-22 UK tax year submission deadline is the 31st of January 2023.

- You need to pay any tax you owe by the submission deadline.

- Are you registered as self-employed? If you have earned over the tax threshold for self-employed people and haven’t registered for self-assessment with HMRC, you’ll need to make sure you do so as soon as possible. You will only receive your ‘activation code’ 10 days after registration. Once you have registered, you can submit your self-assessment tax return online.

- Familiarise yourself with the tax return forms. Keep a record of all your submission values and claims to keep your accounts accurate each year. If you have any questions while filling out our online forms, you can always use the chat window or email us to connect with an agent.

- Keep in mind any mistakes and errors you made on previous tax filing, and avoid repeating these. It’s a good idea to keep online records, and plenty of accounting tools are available online that help business owners manage their accounts online.

- If you use online bookkeeping/accounting software, submitting your self-assessment tax returns online with us is easy. Simply head over to our self-assessment tax return form and go through the sections with your accounting software open. The submission process should be straightforward if you’re on top of your record keeping. If you’re not confident about what to include, you can always contact one of our team who will be happy to help.

- Keep a record of all your income and expenditure details – Record all your income and expenditure details to be as accurate as possible. This helps avoid complications when filing your tax returns and refunds. Make sure to register and obtain your ‘unique taxpayer reference number’, which you will receive once you register as a self-assessment taxpayer.

- Use the services of tax professionals. A stress-free option for filing your UK tax returns is to get in touch with one of our team at Taxback.co.uk. Our user-friendly website and supportive team can help you save time and money. Use our online forms to submit your self assessment online.

Steps to Follow When Filing in your Self-Assessment Tax Return and What You’ll Need

- Check all your personal details to ensure that it’s accurate

- Only fill in sections applicable to you

- Report your earnings

- Add all tax-deductible expenses

- Double-check your tax returns

- Have a digital copy/scan of your ID (Passport or Driving Licence)

- Have a digital copy/scan of your proof of address (Bank Statement/Service Bill such as electricity or council tax invoice)

- Personal Mobile + Email that you can be contacted on to discuss your tax return

- Check with one of our team if you have any questions before you complete your tax return, or you can always send us an email with any questions

A Step-by-Step Guide to Completing the HMRC Self-Assessment Tax Return

Once you register for the self-assessed tax payment scheme, you’ll be ready to submit your self-assessment. Once you have registered as self-employed, submitting your tax return is compulsory even if you have not achieved a ‘Tax Qualifying Year’. A tax year in the UK is from the 6th of April to the 5th of April of the following year. To avoid being penalised, people completing their returns online must submit the form by the 31st of January next year. If you are no longer self-employed, you should contact HMRC or ask your accountant to de-register you and/ or your business.

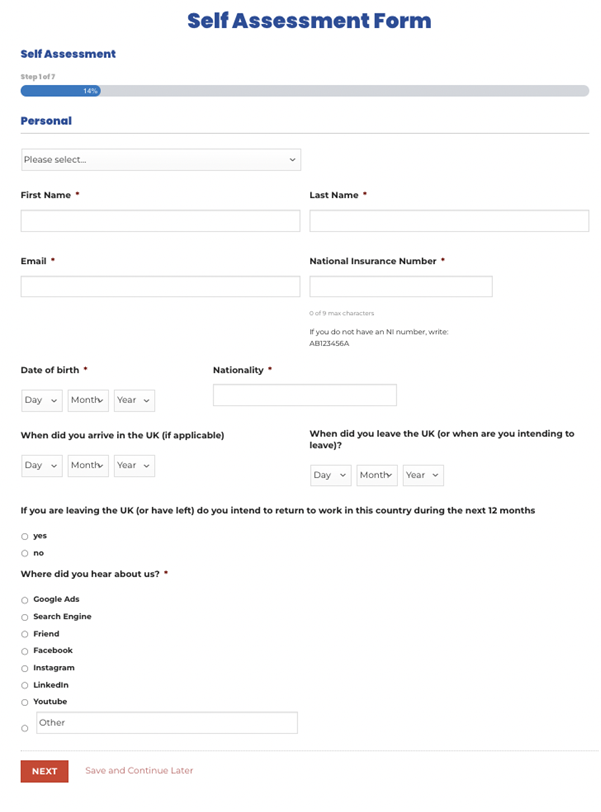

Step 1

Head to our self-assessment tax return form and complete page one to create an account.

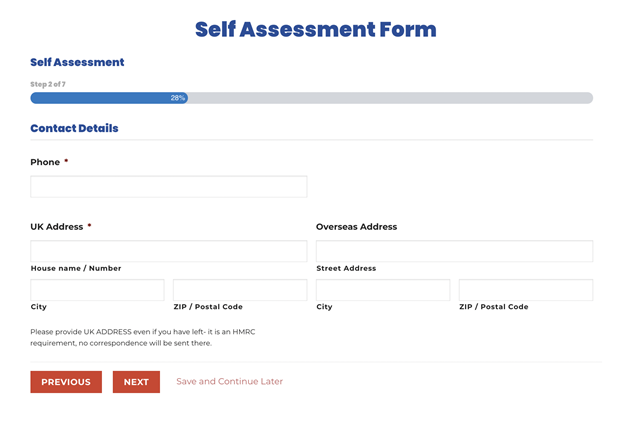

Step 2

Complete page 2 – submit your contact details.

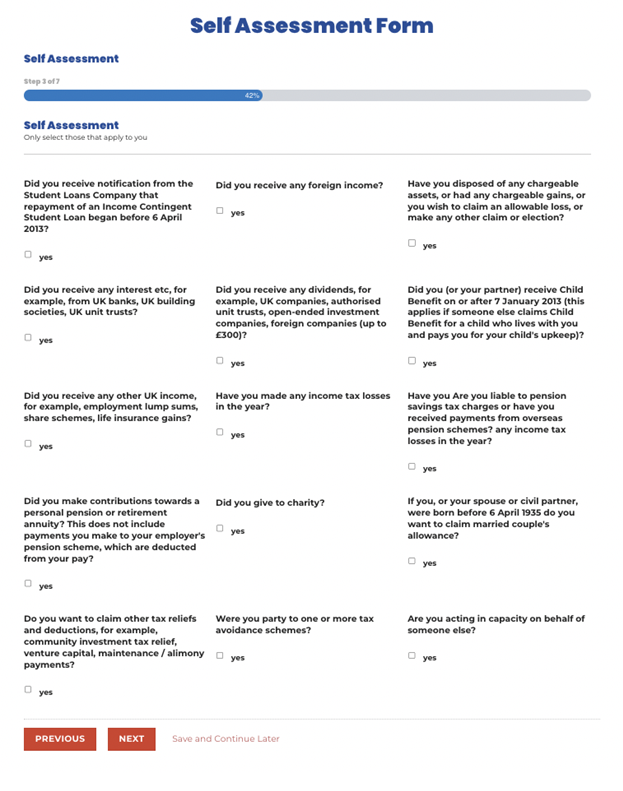

Step 3

Step 3

Complete page 3 – Complete the UK self-assessment tax questionnaire by selecting YES to identify the options that apply to you.

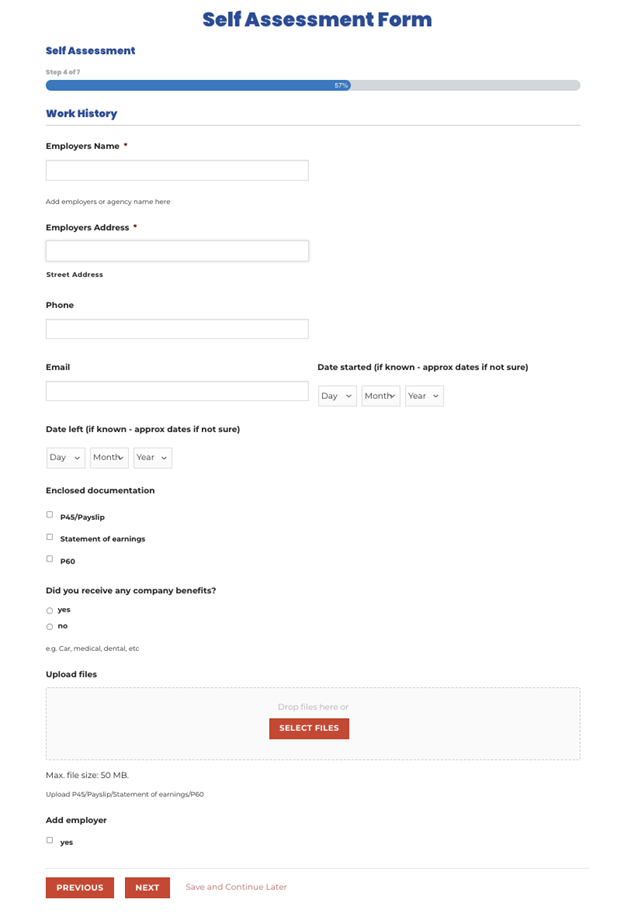

Step 4

Complete page 4 – Submit details of your work history, including past employer contact details.

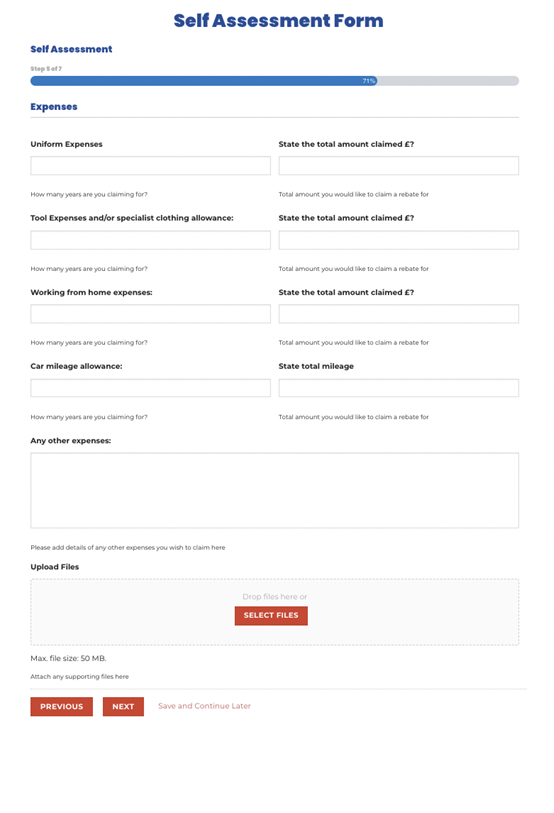

Step 5

Complete page 5 – Submit details of your financial information, including expenses.

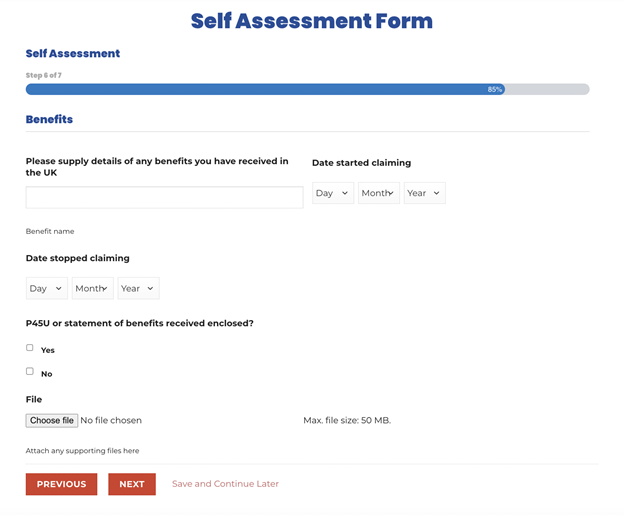

Step 6

Step 6

Complete page 6 – Submit details of any benefits you may have received along with a supporting P45U or statement of any benefits received.

And that’s it! You are on your way to submitting your self-assessment tax return. You can always bookmark this article to reference while you’re submitting your application form via our website.

BOOKMARK THIS PAGE – HOW TO FILL IN SELF-ASSESSMENT TAX RETURN

When Should I Fill in and File my UK Self-Assessment Tax Return?

The 31st of January of each year is the deadline for filing your online self-assessment tax return for the previous tax year.

Do you need help submitting your self-assessment tax return dates? Chat with our team now

Why Should I File in my Self Assessment Tax Returns Early?

Filing your tax returns on time means avoiding spending the festive period busy preparing paperwork! There are several advantages to filing your tax return early and below, we take a look at some of the key points to why it’s better to be organised and file your taxes by the self-assessment tax return dates.

Each year, you must submit and pay any tax owed for your self-assessment tax return by the 31st of January to avoid a late fine penalty. The team at taxback.co.uk are on hand to answer any questions you might have regarding self-assessment filing. If you have any questions about self-employed tax returns, email us or use the chat system.

Filing your self-assessment tax return early allows sufficient preparation time.

You need a ten-digit Unique Taxpayer Reference (UTR) number to begin with. Your UTR can take some time to be sent to you, hence starting early means you give yourself time. You will also need to set up your Government Online Gateway account.

By filing your tax return early, you’ll be able to manage cash flow better.

Filing your self-assessment early will give you more notice to pay any due tax. This will help you plan to ease your cash flow by making provisions and adjusting your finances. You can pay attention to self-assessment tax advice, UK tax rebates and other issues.

Filing your self-assessment in advance gives you more time to consider tax reliefs and exemptions.

If you leave your self-assessment to the last minute, you may miss the wide range of reliefs or exemptions available. You can check out tax planning opportunities if you start filing your taxes early.

Filing early helps to speed up the process of claiming a tax refund.

Filing early may enable you to access tax refunds sooner than later. The tax payment dates will remain the same regardless of when you file. This creates more cash flow advantages.

Filing early gives you more time to avoid mistakes.

Mistakes and errors in your tax returns might result in penalty fines or an investigation. A tax investigation can be a drawn-out and stressful process. Giving yourself plenty of time means you will not need to rush, can pull together all your receipts and can contact a professional for advice if you have any queries.

Being prepared with your self-assessment helps you avoid late filing penalties from HMRC.

Leaving your filing until the last minute puts you at risk of missing the deadline. Penalty fines for late filing can range from £100 to 100% of your tax bill. So make sure you allow sufficient preparation time.

If you need any assistance when it comes to filing your self-assessment tax return form, please get in touch with our team of UK tax professionals, or you can complete our online self-assessment tax refund application form.

Self-Assessment Tax Return Mistakes to Avoid

Using the wrong tax code

Many taxpayers could be paying too much or too little by being on the wrong tax code. Ensure that you enter all the details from your PAYE employment accurately on your Tax Return. You may even be eligible for a tax refund, even if it’s been quite a few years.

To claim or not to claim

Knowing what is and isn’t allowed to be claimed is not easy. Of course, you want to ensure that you are using all available allowances, but beware of the penalties for incorrect claims. When in doubt, it’s best to speak to a tax professional to clear any doubts and queries you may have.

Not including interest on income

When doing your Self-Assessment tax return, have all documents relating to your savings and investments ready, and accurately state any interest earned: interest earned from savings, online peer-to-peer lending, credit unions, friendly society accounts and dividends from UK companies. Interest from ISAs doesn’t need to be declared.

Incorrect pension contributions

Payments into a pension need to be accurately entered on your tax return: too little, and you miss out on tax relief. Too much, and HMRC could charge you. If your employer deducts pension contributions from your salary, you won’t need to enter these on your tax return.

Missing the deadline

The best Self-Assessment tax advice is to file your tax return correctly and on time. Leaving your Self-Assessment until the last minute can lead to errors and missed deadlines. Penalty fines can range from £100 to 100% of your tax bill.

How to Appeal an HMRC Self-Assessment Penalty

If you have received a fine from HMRC, read on to find out how you can appeal a Self-Assessment penalty and get it delayed or reduced. If you appeal to the tribunal, HMRC will wait for your payment until the tribunal sorts out your appeal. What’s important is that you act fast and get help.

The best way to avoid making errors with your UK Self Assessment Tax return is to get help from a professional tax agent. Talk to our team today about receiving support with your self-assessment.

Why did I receive a self-assessment tax return fine?

Self-assessment tax return fines are usually sent out for one of two reasons. A failure to notify means you didn’t file a tax return, but HMRC believes you should have. The other reason is late filing or late payment for the tax owed.

How do I appeal a self-assessment penalty?

You can appeal online or by phone if it’s a £100 late filing penalty. You can print and send the SA370 form via post. Either way, you must provide a plausible reason or excuse for the lapse. When it comes to UK tax returns for non-residents, similar rules apply.

What counts as a reasonable reason?

Anything that prevented you from doing your taxes: the death of a family member, a severe illness or your computer failing as you were filing. It could even be that the HMRC online services didn’t work or an emergency like a fire, flood, theft, or other significant incidents.

What does not qualify?

Some reasons that won’t work are: you asked someone else to do your taxes, and they didn’t do it, your payment failed, you didn’t know how to use the HMRC’s website, you made a mistake on your tax return, or even though you registered for online filing before the deadline you didn’t get your access code in time.

How much time do I have to appeal?

You have 30 days to appeal. If your appeal gets rejected, you can appeal to the Finance and Tax Tribunals within 30 days or consider an alternative dispute resolution. If you can’t pay the penalty, make a hardship application with HMRC.

If you appeal to the tribunal, HMRC will wait for your payment until the tribunal sorts out your appeal. What’s important is that you act fast and get help. The best way to avoid making errors with your UK Self Assessment Tax return is to get help from a professional tax agent. Talk to our team today about receiving support with your self-assessment.