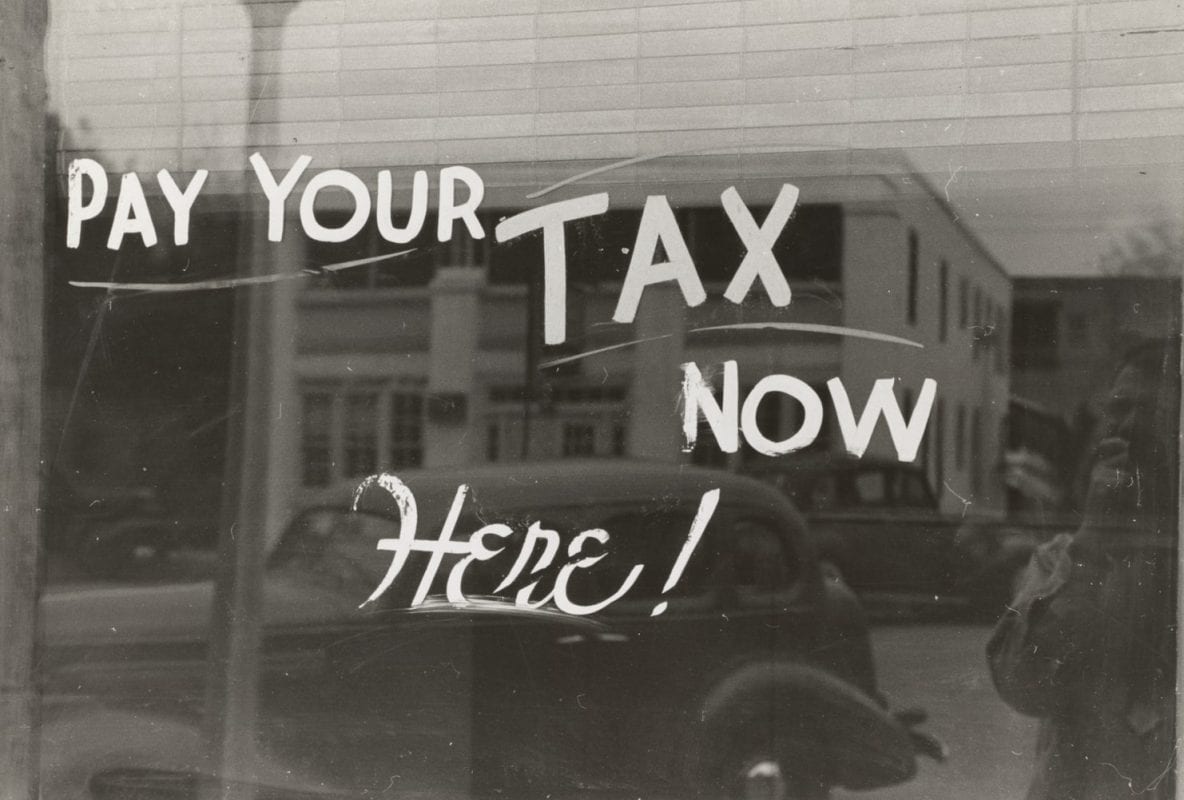

When it comes to UK tax returns and student tax refunds, many things can be confusing. You will have many questions; Am I doing it right, will I get penalized, etc. Well not to worry our guide below has you covered as we discuss how to pay your tax bill. How to Pay Your Tax […]

If you are a small business owner who has never filed a tax return before, don’t panic if the January 31 deadline looms. Read our guide on UK tax tips and how to get organised with UK tax refunds. Register with HMRC If you are planning to submit your tax return online, you will need […]

If you plan to work abroad for some time, there are tax considerations you have to take into account. Whether it’s UK tax for foreign nationals, or Self-assessment tax return advice, we cover the basics below so that you have an understanding of what is required. What Do I Need to Consider if I Am […]

It is the usual practice of the HMRC to send out letters to tenants where the property is believed to be owned by an overseas company. This article explains more about the letters, Uk tax return, and Paye tax refund. Why is HMRC Sending These Letters? HMRC sends out compliance letters to tenants of residential […]

The Unique Taxpayer Reference Number or UTR is an exclusive 10 digit code that’s allocated to you or a company by Her Majesty’s Revenue and Customs (HMRC). This code helps HMRC personally identify you with reference to any tax responsibilities or rebates. If You Have A UTR Number And: Work in trades, you need to […]

If you have received a fine from HMRC, our guide will tell you how to appeal a Self-Assessment penalty, get it delayed or reduced. If you appeal to the tribunal, HMRC will wait for your payment until the tribunal sorts out your appeal. What’s important is that you act fast and get help. The best […]

Tax credit debts and how they are collected keep changing, which is why you should not ignore any letters you receive from HMRC. Read on for a breakdown of tax credit debt and UK tax advice, including self-assessment tax advice. The Department of Work and Pensions (DWP) announced that a segment of tax credit debt […]

It’s that time of year when UK Self Assessment tax returns must be prepared and submitted to HMRC on the 31st January. If you’re not organised this task can be time consuming, and can be daunting and stressful but nevertheless it has to be done or you will receive a late filing fine. Do You […]

In the United Kingdom, small businesses face a number of taxes that they must pay. It is also important that you understand which legal structure is best suited for your small business before registering your new business. Small businesses in the UK are subject to a number of taxes, depending on the performance of your […]

Self-Assessment Tax doesn’t have to be taxing and it shouldn’t be with these articles. From understanding self-assessment tax returns to guides on how to complete the paper and online versions themselves, it’s all here. There’s also information on which deadlines to look out, which mistakes to avoid, what taxation applies to you and how to […]