Whether operating as a sole trader, partnerships or companies, a business within the mainstream construction sector must comply with the Construction Industry Scheme – also known as CIS. Apply for a CIS Tax Refund What is CIS? It is a tax deduction scheme where tax is taken from the source of the payment, rather than […]

Are you in the trades industry? If you want to work in the UK, there are plenty of building and construction trades and labour recruitment companies that you can refer to for job options. Do you need to claim a CIS Tax Refund? If you work in construction you may be owed a tax refund […]

How your tax is treated as a foreign worker in the UK construction industry depends on whether or not the Construction Industry Scheme (CIS) applies to you. If your income tax and National Insurance contributions are deducted through the PAYE system, then CIS is not applicable in your situation, which is actually a more convenient […]

As a construction worker in the UK, and are paid under the PAYE (pay as you earn) scheme then you will be entitled to claim expenses for certain items and services. This is known as tax relief as your expenses are deductible against the tax you pay on your earnings. If you are currently employed […]

Tradesmen and construction workers paid under PAYE in the UK are entitled for tax relief for a wide range of expenses and equipment. if you’re planning on working in construction on your UK working holiday, make sure you know what you can claim for with our tax tips. Travel Expenses A construction worker who travels […]

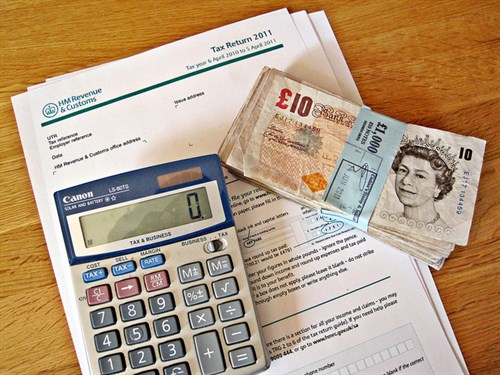

If you are contracting in the UK’s construction sector, then seeing if you are entitled to a tax rebate is fairly straightforward, and certainly worth checking out. It is a legal requirement that you submit a tax return annually to the HMRC, assuming that you work within the UK’s construction industry in this instance. It […]

The Construction Industry Scheme Tax (CIS) is a set of taxation rules established by the HM Revenue & Customs (HMRC), mainly for the construction industry. While CIS basically defines contractors and subcontractors as the main entities subject to the tax, there are other classifications. One such designation is a “deemed contractor.” Who does that term […]

- 1

- 2