When is the Self-Assessment deadline for filing Tax Returns? The UK Tax filing deadline for Self-Assessment tax returns is midnight of 31st January. We’ve listed below all applicable tax deadlines falling in between the 6th April and 31st January cut–off date. Not all criteria will be applicable to you but we find that our clients […]

Benefit from UK tax refunds for non-residents Not all international students in the UK are eligible for tax filing. If your earnings are used to fund your studies, accommodation etc. you are eligible for a tax-exemption provided your country of citizenship has entered into a double taxation agreement with the UK. Read on and find […]

A Look at UK Tax Refund for Non-Residents This article takes a look at the special tax rules which affect international students studying in the UK. The following subjects offer you an insight to rules governing non-resident UK tax. And benefits you can look at such a UK tax refunds for non-residents. Do international students […]

Claim UK Tax Refunds for Non-Residents Working students do have to pay income tax just like all other employed Britons and must contribute towards National Insurance. But there’s loads of good news, students on grants or student loans are exempt from paying tax, plus you only start paying tax once you exceed your ‘Personal Allowance’. […]

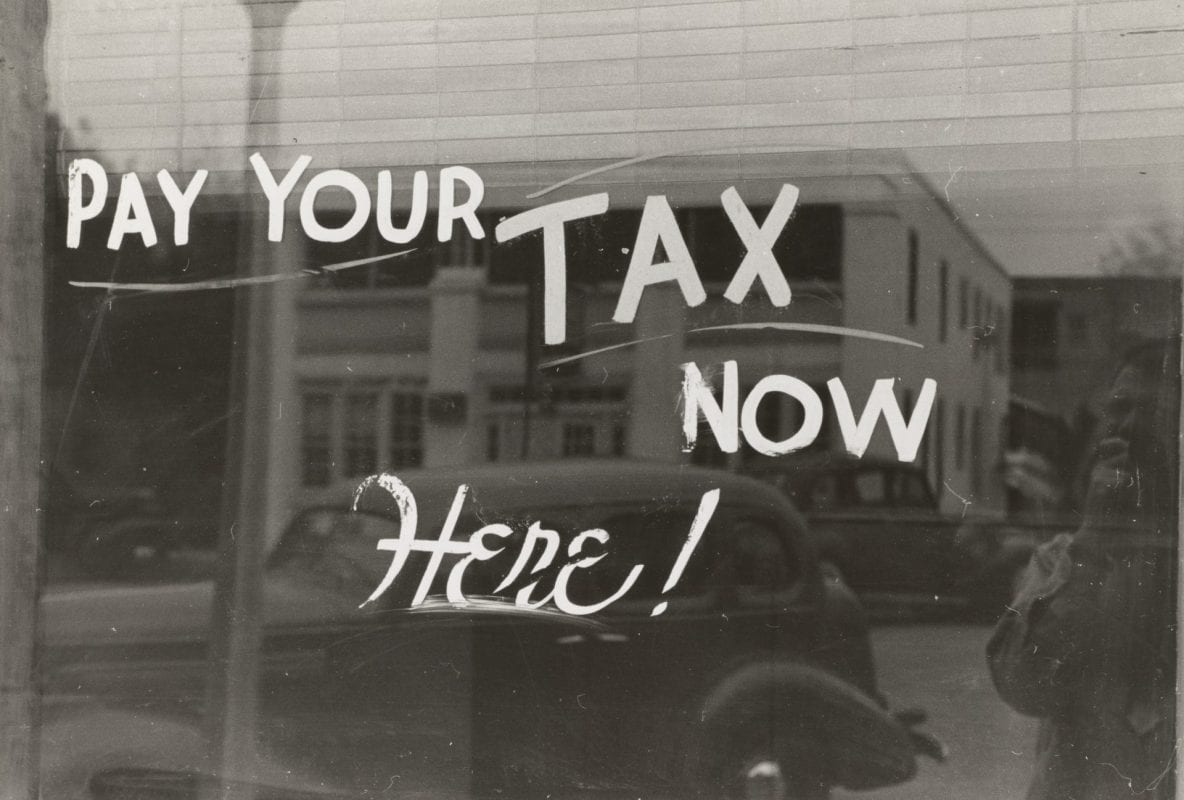

New Changes to Consider for your UK Tax Refunds The new tax reforms introduced by April 06th will see over 32 million people paying less tax in the UK. However for the self-employed it’s not all ‘good news’, we see a few changes which will not be beneficial to self-employed UK tax payers. How will […]

A Creative Way to Use your UK Tax Refunds Living in London is expensive, but if you know how, it’s possible to enjoy your time in the bustling and exciting city, without draining the budget. If you didn’t already know, managing your UK tax refunds will be a fine way to supplement your earnings, and […]

When UK Tax Refund for Non-Residents Count With 28 countries, the EU is a pretty hot place for tourists to explore! If you are a student or foreigner working in the UK, your UK tax refund for non-residents can be put to good use as you satiate the wanderer in you. This article offers you […]

Tax Refunds UK Explained! We all have to pay tax, it’s a fact of life, but did you know that there are times you may pay HMRC too much tax, which you can claim back. This article educates you on how you can apply for tax refunds; UK Inland Revenue has several options and with […]

Time to Meet that 2019 UK Tax Filing Deadline! There are over 740,000 tax payers in-line to receive fines for missing their deadline to file tax returns. Official notices, however, will not be sent out until April as announced by HMRC. If you met your 2019 UK tax filing deadline your tax returns for 2017/18 […]

Are you eligible for UK tax refunds? Have you been paying the wrong amount in tax? We find that many people are; the mistake can be from either side with even HMRC making the occasional error. UK tax mistakes can range from people having the wrong tax code to incorrectly filed tax return forms. Read […]