New Changes to Consider for your UK Tax Refunds The new tax reforms introduced by April 06th will see over 32 million people paying less tax in the UK. However for the self-employed it’s not all ‘good news’, we see a few changes which will not be beneficial to self-employed UK tax payers. How will […]

A Look at Seafarer Tax Return The Seafarers earnings deduction as part of HMRC’s legislation allows people working onboard ships to claim a tax relief of 100% on foreign earnings. There are clauses though, you need to work out the intricacies of how you qualify and which vessels HMRC class as ships. This article sets […]

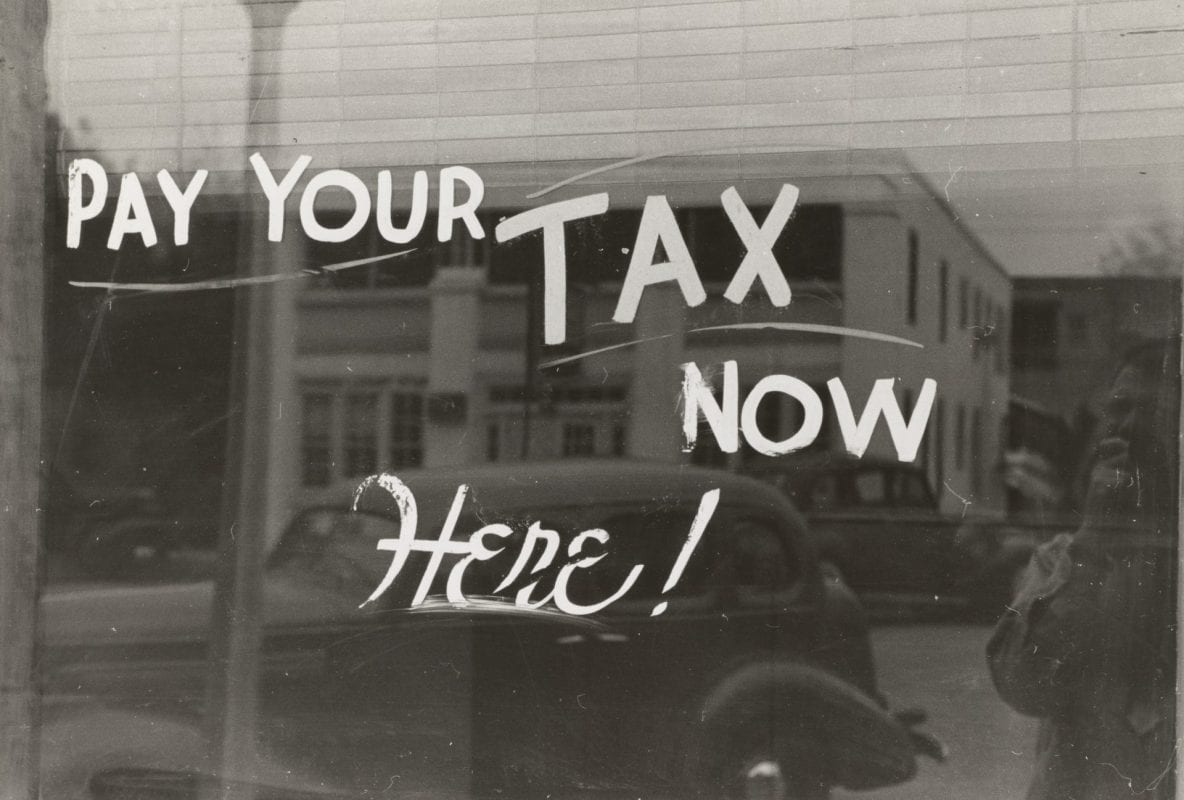

Owing unpaid tax to the Internal Revenue Service (IRS) can have very serious repercussions unless you take appropriate steps to prevent them. The good news is, with a bit of professional advice, you can not only avoid the worst, but it is even possible to reduce the total due tax amount. Read on to know […]

A Creative Way to Use your UK Tax Refunds Living in London is expensive, but if you know how, it’s possible to enjoy your time in the bustling and exciting city, without draining the budget. If you didn’t already know, managing your UK tax refunds will be a fine way to supplement your earnings, and […]

When UK Tax Refund for Non-Residents Count With 28 countries, the EU is a pretty hot place for tourists to explore! If you are a student or foreigner working in the UK, your UK tax refund for non-residents can be put to good use as you satiate the wanderer in you. This article offers you […]

Tax Refunds UK Explained! We all have to pay tax, it’s a fact of life, but did you know that there are times you may pay HMRC too much tax, which you can claim back. This article educates you on how you can apply for tax refunds; UK Inland Revenue has several options and with […]

Time to Meet that 2019 UK Tax Filing Deadline! There are over 740,000 tax payers in-line to receive fines for missing their deadline to file tax returns. Official notices, however, will not be sent out until April as announced by HMRC. If you met your 2019 UK tax filing deadline your tax returns for 2017/18 […]

Are you eligible for UK tax refunds? Have you been paying the wrong amount in tax? We find that many people are; the mistake can be from either side with even HMRC making the occasional error. UK tax mistakes can range from people having the wrong tax code to incorrectly filed tax return forms. Read […]

Time to Enlist the Services of a UK Tax Agent! Both you and HMRC can make mistakes on your UK tax returns; if you believe your tax returns to be inaccurate there are measures to be taken, as listed in this article. Also, consider obtaining the services of a qualified UK tax agent, to ensure […]

Use your UK Tax Refund for Non-Residents to Travel Europe remains a top travel destination. The continent while being fascinating is not cheap to travel on a small income, unless, of course you benefit from annual windfalls such as your UK tax refund for non-residents, that’s right HMRC is happy to pay back any over-charged […]